I've made mention of the fact that I'm gonna talk about Financial Management and Money Management Principles and have made a few references to "Rule #" such and such and all that.

First of all, let me say I am not a Financial Advisor, Financial Planner or anything.... I have no accreditation in anything financially related and I have made as many or more mistakes financially as the next person.... anything I say is to be taken with a grain of salt.... and if it's not it is to be sliced, diced and filtered through each individual's own little Veggie-matic.... that thing you call your own brain, experience, preferences, etc.

What I say about financial managment, planning or anything money related is my own personal opinion, perspective and approach based on my priorities, personalities and weird idiosyncracies!

So Reader Beware!..... or Caveat Emptor.... or Laissez Faire.... or E Pluribus Unum.... or Habeus Corpus....

.... or whatever other Latin or other antiquated language expression that says "You're on your own Buddy!"

With all those qualifications, disqualifications and general non-sense stated, here's how I go about buying real estate:

- Step 1: You have to have your financial ducks in a row before you even think about buying a house. I'm kinda getting the cart before the horse.... talking about buying a house because that's just part of an overall financial plan.... but since that's one of the umpteen things I been working on I figured I'd talk about it. Before you even think about buying a house, here's some things that should already be in place - You should already 1) have a monthly budget in place and 2) be adhering to that budget and 3) have tracked that budget for at least 12 months and 4) have at least 6 months of your TOTAL BUDGET in the bank as an EMERGENCY FUND! If you are doing that.... then you've already completed the first critical steps to any sound family financial plan - you have a plan, you know where you are (what you're spending) and you are tracking / controlling your spending (you're following a budget / the plan) and you have a back up plan - kinda sounds like the prerequisites for a cross country journey doesn't it..... violate any one of those critical steps and guess what.... you get lost.... or worse!

Step 2: Decide how much you can spend on housing / home / your next real estate purchase. Now you see why you had to have a budget in place already. If you have a budget in place, you are already tracking your housing costs and you know how much total you have going out and coming in and how much you have in savings... and NO - the EMERGENCY FUND does not count as savings or down payment.... as far as you're concerned it doesn't exist.... you don't put it in any risk assets (like the stock market).... you don't tie it up for any length of time (like in a long term CD).... it stays in a dedicated savings or money market account that allows quick and easy access. At this point, some or most of you may be saying - What's this guy smoking? I can't even pay my bills, buy groceries for my kids and this guy's talking EMERGENCY FUND! I got it .... I understand... I grew up dirt poor myself.... I know what it's like... but you know what... you got to overcome the thought process of "the world's got me down and it's stomping on me!" DO WHAT YOU GOTTA DO! If you're not making enough money to make ends meet, sit down and think and make a plan - can you get more schooling that will give you a better opportunity for better pay? Can you relocate where the cost of living is lower and the pay is higher? Can you give up a bad habit that's costing you money - like smoking or gambling or chasing wild women or wild men? Hell I don't know what' s up in your life but I can tell you... I ain't talking down to nobody cause I've been at the bottom looking up.... so take heart.... you can do it! Now back to the regularly scheduled program.... Bottom line is that there are easy to use calculators out there that take a combination of data like interest rate, duration of loan and beginning principal and spit out a monthly payment and don't forget to add in TAXES and INSURANCE to the mortgage payment calculator. In my opinion, you should put down as much as possible on a house .... I don't like or endorse going into debt and the ONLY THING I would endorse going into debt on is what is known as an Appreciating Asset... like real estate.... not cars, boats, 4 wheelers and for God's sake.... don't borrow money and put it in the stock market! I know... I know... real estate can go down in value too.... that's what precipitated this whole economic crisis.... the drop in housing prices in highly inflated markets like Miami, Las Vegas, Phoenix and places in California and the subsequent default of mortgages and the subsequent bankruptcy of the "payers" of these insurance policies on mortgage defaults aka CDS's aka Credit Default Swaps.... spare me the details.... I been reading about it for 5 years..... 2 years before it happened.... I understand it .... I just shake my head and realize that it was just another financially engineered instrument for transfer of wealth from the lower and middle class (out of their 401k's) to the upper class (hedge fund owners)..... I'm 47 and I've seen this cycle about 5 times now.... and if you don't know it, realize it and protect yourself from it, then you'll end up after 30 years with not much in your 401k living on Social Security (yeah right - it'll probably be abolished just about the time I'm eligible for it) and wondering where all that money went that you "saved" in your 401k..... the whole system is engineered by a very few people in control to take your money... and they will do it.... unless you protect yourself.... WHEW! I got that little gripe off my chest.... now let's go on with the plan of buying a house! Once you've figured out how much you can put down on a house and how much you can afford to pay monthly and not violate your budget, then you have a total purchase amount.... in another words you've figured out how much you can spend on a house. Let me give you an example... let's say you have $5000 in savings to put down on a house and you can afford about $600 per month in total housing monthly payment - How much house can you buy? Here's a link to a Comprehensive Mortgage Calculator that's available on Yahoo Finance: http://finance.yahoo.com/calculator/family-home/hom03 The way most of the calculators are set up is bassackwards.... they should be set up to where you put in the mortgage payment you can afford, the annual taxes and insurance on the property and the term you want to pay in and the interest rate for that term and then it spits out the principal amount (amount to be borrowed)... but that's not the way it works.... (just part of the financial pitfalls that are engineered to bury you in debt you can't afford).... you got to put in a principal amount and all the other stuff and then it spits out your mortgage payment.... so to make the resulting mortgage payment match up with your budgeted housing amount.... you gotta do a trial and error input on the principal amount to get it right.... get it? Let me show you an example with the data from above... I've already "played" with the calculator so I know the right principal amount to get the $600 per month payment but this is just to show the process anyway.... so here's a couple of "screen shots" that show the input and the results:

The next screen shot shows the results:

You can see at the bottom of the screen shot that with this data you get a total monthly payment including principal, taxes, insurance and $0 for PMI of $605.86 - close enough to the desired $600 budgeted amount.... and you end up paying $19054 in interest over the 15 year life of the loan.

Oh and one other thing.... PLEASE DON'T GET A 30 YEAR MORTGAGE! You will pay 2 - 3 times more interest on a 30 year mortgage than a 15 year mortgage and the monthly payments aren't that much different.... if you're considering making a decision to get a 30 year vs 15 year mortgage - do 1 of 2 things.... either save a little more down payment or buy a little less house and stick with your budgeted housing amount.

I did the exact same deal except changed the loan time to 30 years and the interest rate to 5.5% (for a 30 year loan) and guess what the interest paid was? Take a look.

Check that out at the bottom.... you only pay $100 less per month but you pay $46982 in interest which is $27928 more in interest compared to the 15 year mortgage... so let me add this up and subtract that out....

15 year $45000 loan at 5%..... I pay a total of 180 payments of $605.86 (including taxes and insurance) for a total of $109054 over the life of the loan (remember that includes taxes and insurance).

30 year $45000 loan at 5.5%.... I pay a total of 360 payments of $505.51 = $181984......

so I pay a total of $72930 MORE for the house and I DON'T OWN IT OUTRIGHT FOR ANOTHER 15 YEARS!

Holy Declining Net Worth Batman!.... why don't they teach us this &*%! in high school or something?

Ok.... point made.... let's move on!

- Step 3: Become an Expert! On the area where you want to buy.... on the houses in that area.... on the prices of the houses in that area.... on everything associated with and remotely related to buying a house in the state, county, city, area, subdivision, street and dirt where you want to buy a house....Become an expert on it!!! Huh? Don't they have people that do that for a living.... called real estate agents? Yes they do and guess who they represent (in most cases unless you sign a contract, pay them a fee and hire them as a "buyer's representative")..... they represent the SELLER! Now let me say right here right now.... I got nothing against real estate agents.... all of them that I've met are great people.... they work hard for their commissions... they have to take what basically amounts to about 2 - 3 semesters of classes to get their real estate license and they have to handle and process a ton of convoluted and confusing paperwork.... but the bottom line is that their (I'm gonna use a big word here) FIDUCIARY RESPONSIBILITY is to the SELLER ....NOT YOU! That's the way the system works... you know let me just divert here for a minute and throw out another little observation.... well kind of an exaggeration maybe... but you'll get the point..... I have seen people spend more time researching the label on a 67 cent can of green beans in a grocery store aisle than they spend buying a $150000 house.... I'm serious.... people just throw their hands up and say.... "I don't know nothing about that.... just shove the papers at me and let me sign away my financial life for the next umpteen years and I trust you that I'm getting the best house at the best price and it's in good shape and it's not about to fall off in a sink hole or get flattened by a mudslide or flooded by a hurricane or burnt down by faulty wiring...." Geez.... it's no wonder.... oh boy.... I'm not gonna say it .... let's move on! So how do you become an expert? KNOWLEDGE IS POWER GRASSHOPPER! So how do you get knowledge... you get it 1 piece of data at a time and you document it and you compile it and you compare it and you use it to make sound decisions with that hat rack on your shoulders you call a head... you use your noodle and you trust yourself and no one else and you INSPECT and VERIFY and DON'T ASSUME ANYTHING! By now you're saying, this guy lost me about 14000 words ago.... well you know what.... this is a complicated and complex world filled with a lot of information and misinformation and you gotta do what you gotta do to parse it and break it down and nibble at it and package it to where you can handle it..... if you can't do it.... find someone who you trust and have them help you do it and learn from them! There's too many victims in this world! Don't be one of them.... Ok to the nuts and bolts of data collection... Here's a series of screens shots showing an Excel worksheet that I've prepared to begin collecting all this information that's gonna turn me into an expert on real estate in Santa Fe....what do I mean by expert? I mean I wanna feel confident that, at the end of this process, I can buy a quality home that meets my wife and my criteria at a price that is significantly below "market value".... how much below? I don't know.... I haven't collected the data yet.... I'm not an "expert" yet... but I will be and here's how I 'm gonna do it. First, I do a quick Internest search for banks, mortgage lenders and real estate agents in Santa Fe and get some names and numbers.... here's my worksheet for that info:

Pretty simple huh? Well this is just the first step in data collection.... the next one has a little more to it.

Anyway, in this stage you get people's names and numbers and you call them up and tell them your name and tell them you're looking to buy a house in the area. Now remember I'm looking for a bargain.... and these are times when real estate bargains do exist.... so what do I ask about....the code word for bank or mortgage company foreclosures is "real estate owned" aka REOs... tell them your criteria... you know like 3 bedroom 2 bath 2 car garage 1500 - 2000 ft2 adobe style construction, etc.....ask them to e-mail you a list of the REO's aka foreclosures they have that meet that criteria.... preferably in Excel format.... that way it's easy to copy and paste into the worksheet....

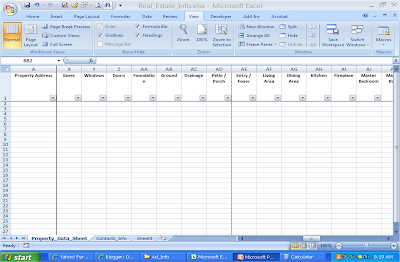

Then you start filling in the data in the following worksheet (now this thing is several pages wide because there's so many columns).... you may not have to collect this much detailed info but I wanted a "comprehensive checklist" for each house I was considering so I could remember and compare.... and narrow down... so here's some screen shots of that worksheet.....

Now let me tell you what has happened with me when I've done this in the past.... you're gonna look at a bunch of houses in different areas and different subdivisions and you're gonna take notes and make observations and come back and populate this worksheet and at first, it's just gonna look like a bunch of random information.... but after you've looked at 20 - 30 properties and you start grouping them together in similar location or similar square footage or whatever, you're gonna see something emerge.... you're gonna start seeing the lower $ / ft2 numbers emerge.... that's what I want to see... I want to know for any given location or subdivision and for a given square footage and architecture and for given features.... I want to know how much I'm gonna have to spend per square foot.... I've already learned from my conversations with the contacts I have that the $/ft2 will vary significantly in Santa Fe depending on where you buy.... fine... good to know.... downtown near the plaza and Artist Road is more expensive.... it's expensive out by St. John's College... less expensive by the Santa Fe Community College.... and after talking with 5 or 6 folks I already have a good idea of what a bottom dollar cost per square foot is ..... now I'm taking the first steps to become an expert..... Oh yeah.... 'bout now you're probably saying "Yeah... this guy's got the time to do this".... well it didn't take that long.... heck I've spent 3 times longer typing up this post on what I'm doing than the actual doing that I've done.... if that makes any sense..... I probably got about an hour and a half of phone time in and maybe 15 minutes to set up the worksheet.... let's see I've invested maybe 2 hours into a process that involves one of the largest purchases I will likely make in my life and that will determine where I live for the next few years.... yeah I can spare a few hours to do that.....

- Step 4: Once I go through the "Become an Expert" process, I will have narrowed down the list to a few choice properties.... I want to have more than one choice.... I've got to make sure I have completed all the inspections on the checklist..... I mean I'm gonna check, inspect and test everything... I'm gonna crawl through the attic, run the water in every faucet, flip every light switch, start a fire in the fireplace, plug a little light into every socket, run the dishwasher, turn on the AC, turn on the heat, get up on the roof and walk around, check the caulking around the tubs, look in the crawl spaces... by the time I get through with this house I'm gonna know it like the back of my hand.... no stone unturned. I'm also gonna find out the name or names of a few reliable independent inspectors and select one.... not for inspection now.... that comes a little later.

- Step 5: Once I go through the final personal inspection process on a few choice properties that we've narrowed the list down to and my wife and I have found what we think is the ideal house for us and it's at a good listed price based on the extensive analyses, inspections and comparisons we've done on many properties then we're ready to make an offer. Guess what I don't do? I don't offer them what they're asking for it.... I don't get this.... people seem embarassed to ask people to lower their offering price on anything.... folks... EVERYTHING IS NEGOTIABLE! Well almost everything... you get what I'm saying. I just basically assume that the offering price is at least 20% higher than what the seller will take for what they're selling.... so I'm gonna offer significantly lower than the asking price.... in fact I've already got a fixed price in my mind of what I'm willing to pay for the house... I've got a top dollar price.... no higher.... how did I come to that price? I looked at all the data I collected and came up with my price.... sounds bogus.... fine.... you go through the process and see what happens....so I got a price that I'm willing to pay for this house.... is that what I offer? NO... OF COURSE NOT - that's not how it works.... I look at the difference between what they're asking and what I'm willing to pay and I subtract that from what I'm willing to pay and that will likely be my offer... .what are you talking about? Let me give you an example - Let's say I want to pay $80000 for the house of my choice.... the seller's asking price is $100000... difference is $20000.... my offer will be $80000 - $20000 = $60000.... why? Because if you split the difference between the ASK ($100000) and the OFFER ($60000) what do you get.... yep the $80000 price that I'm willing to pay.... SELLER and BUYER meet in the middle and both parties think they've negotiated a good deal.... which they have.

- Step 6: Make the offer official.... sign an Earnest Money Contract... with qualifications.... whoa - what's that mean - with qualifications? Never make a written offer on a house or anything of significant value without having some "OUTS" or at least some hurdles / events / contingent criteria that have to be met.... for example, the most common qualification is that a BUYER will have to sell their current house before purchasing the new house.... old house don't sell in a given length of time... offer on new house is null and void.... simple as that. Another common offer qualification is that the offer is contingent on the buyer receiving adequate financing to buy the house.... mortgage lender doesn't qualify him for the loan... offer on new house is null and void.... simple as that. One I always put in is that the house has to be inspected by a licensed residential inspector and I have to approve the inspection.... I don't like something about the inspection.... offer is null and void... You want the seller to replace the carpet with a carpet of your choice.... put it in as a qualification.... you get the picture.

- Step 7: Let's say the offer goes through.... the Property and the Seller meets all the qualifications.... purchase of the house is a GO! All that remains is closing on the house RIGHT?... this usually occurs at a Title Company with a Title Agent sitting down with a stack of documents about 6" thick and they start passing the documents around for the Buyer and Seller to sign..... WRONG! That's not the way to do it! Closing costs and documents should be ready for your review well in advance of the closing... at least a week or two before the closing.... Make an appointment with the title agent to have the documents ready for you and sit down and review them.... if you don't want to do that or you don't feel comfortable doing that.... get a copy of all the documents and take them to a lawyer of your choice (that is independent of the Seller and the Title Company) one that represents your interests and have him review the documents.... Review the total costs that will be due from you at closing... there's gonna be stuff you haven't even considered... you'll have to pay a proration on the taxes and pay for insurance for the coming year.... and pay for this recording and that recording and this fee and that fee....usually it's about 5% (may be as much as 10%) of the purchase price of the house.... oh and here's the deal .... you can get the Seller to pay for things that you might normally have to pay for... BUT you need to think about that ahead of time and put it in the qualifications of the Earnest Money Contract in Step 6.....

- Step 8: Once all the documents are reviewed and approved to your liking and the closing is imminent, you probably need to make contact (if you haven't already done so) with the local utility, TV, internet, etc. companies and the Post Office and anything or anybody else to make sure this stuff is turned on, pointed in your direction and going to the right place. Bottom line is you're moving to a new place and you need to make sure your life is moving with you. Don't wait till after you move in and you're sitting there in your new house with no electricity and no heat freezing your bejeebers off to call the utility companies.....

- Step 9: Close the deal... you've done your homework.... now pull the trigger! Once you're done and everything is recorded and documented, put a copy of the documents in a Safety Deposit Box at your bank or credit union or in some place of safe keeping.

- Step 10: Move in and Enjoy your new home in the Confidence that you've made a great investment in your financial future.... and you did it yourself!

Real estate purchase or ownership may not be suitable for all individuals. Consult a real estate broker or other professional to determine your suitability. The advice given above is of a general nature and should not be taken as a recommendation to buy or sell real estate.

No comments:

Post a Comment